Unlike the hidden fees you’ll get with your bank, Wise’s fees are transparent and much lower.īesides, over 30% of Wise transfers arrive instantly. When you set up a money transfer, you’ll see all the fees upfront, and the exchange rate is guaranteed for 2-72 hours, depending on the country.

#Transfer wise full

They will be paying in their currency and probably to a local bank account, but you’ll still receive the full amount with a minimal fee and no hassle!įirst, Wise uses competitive, mid-market currency exchange rates. Moreover, if you’re a freelancer or run a multinational business, a Wise account makes it much easier for your international clients to send you payments. With the Wise debit card, you can withdraw money from an ATM while visiting another country without the hefty fees that traditional banks slam you with. Travelers who need to pre-pay for a local tour or people with property in multiple countries can use Wise’s international money transfers to handle foreign payments with efficiency and ease. Wise takes the headache out of international payments, charging cheaper fees than traditional banks and allowing you to send money when it’s convenient for you. Who Wise is ForĪnyone who works abroad, frequently travels, or deals with multiple currencies should open a Wise account. It has been a lifesaver for us (as Spaniards living in the US) and for our small but international business (with customers in more than 15 countries). If you are wondering if Wise is a bank, I will say thankfully it’s not! It’s much better than that. Plus, they save $1.5 billion every year thanks to Wise’s locked-in exchange rates. It’s no wonder why 10 million people worldwide use Wise to send $6 million every month.

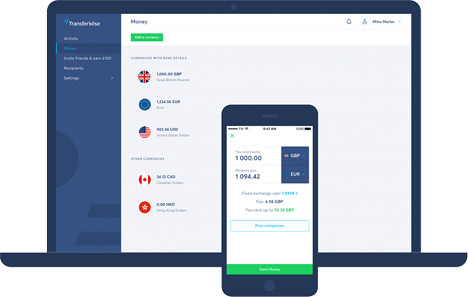

Plus, with the Wise debit card and mobile app, you can keep all the currencies you work with in one place. I appreciate that Wise keeps track of my money every step of the way, keeping me informed through email notifications. Whether you want to pay an employee abroad, send money back to your family at home, or put savings into a bank account you have in another country, Wise has got you covered. With a Wise account in the U.S., you can transfer money across borders knowing you’re always getting the best exchange rate.Įfficient, easy, and transparent, a Wise business account lets you send money via bank debit, wire transfer, or a debit or credit card. Wise, formerly TransferWise, is the fastest and cheapest way to send money internationally.

#Transfer wise how to

In this Wise review, I’ll share my experience after using TransferWise (now Wise) for four years and you’ll learn how to use Wise to transfer money across countries and currencies, always getting the best conversion with no hassle! If you’re a frequent traveler, an international student, a freelancer with customers paying in different currencies or you work abroad, then I recommend getting a Wise account to handle all your foreign transactions. *Wise fees depend on the amount you’re sending, the payment method and the currencies you’re converting. Wise account, multi-currency account, debit card, business accountĪCH, wire transfer, debit/credit card, Apple/Google Pay, Wise multi-currency accountġ-2 days (50% of transfers are done within an hour) WISE (FORMERLY TRANSFERWISE) ACCOUNT & CARD OVERVIEWĥ0+ (most popular: USD, EUR, GBP, CAD, AUD, INR, MXN) Plus, Wise is protected with bank-level security and financially regulated in each country it operates in. Wise makes international transfers and transactions up to 8 times cheaper by using the mid-market exchange rate and charging low upfront fees. Traditional banks can do international wire transfers, but they often come at a high price, thanks to bad exchange rates and hidden fees. Wise (formerly TransferWise) is the best way to send and spend money abroad. Home | Travel | Wise (TransferWise) Review: All You Need to Know

0 kommentar(er)

0 kommentar(er)